PropNex Picks

|November 05,2025HDB resale volume and average resale price slipped in October 2025

Share this article:

The HDB resale flat market slowed substantially in October 2025, with both transaction volume and average resale price easing from the previous month. The moderation is a sign of further stabilisation in the HDB resale segment, as demand- and supply-side measures work through the market.

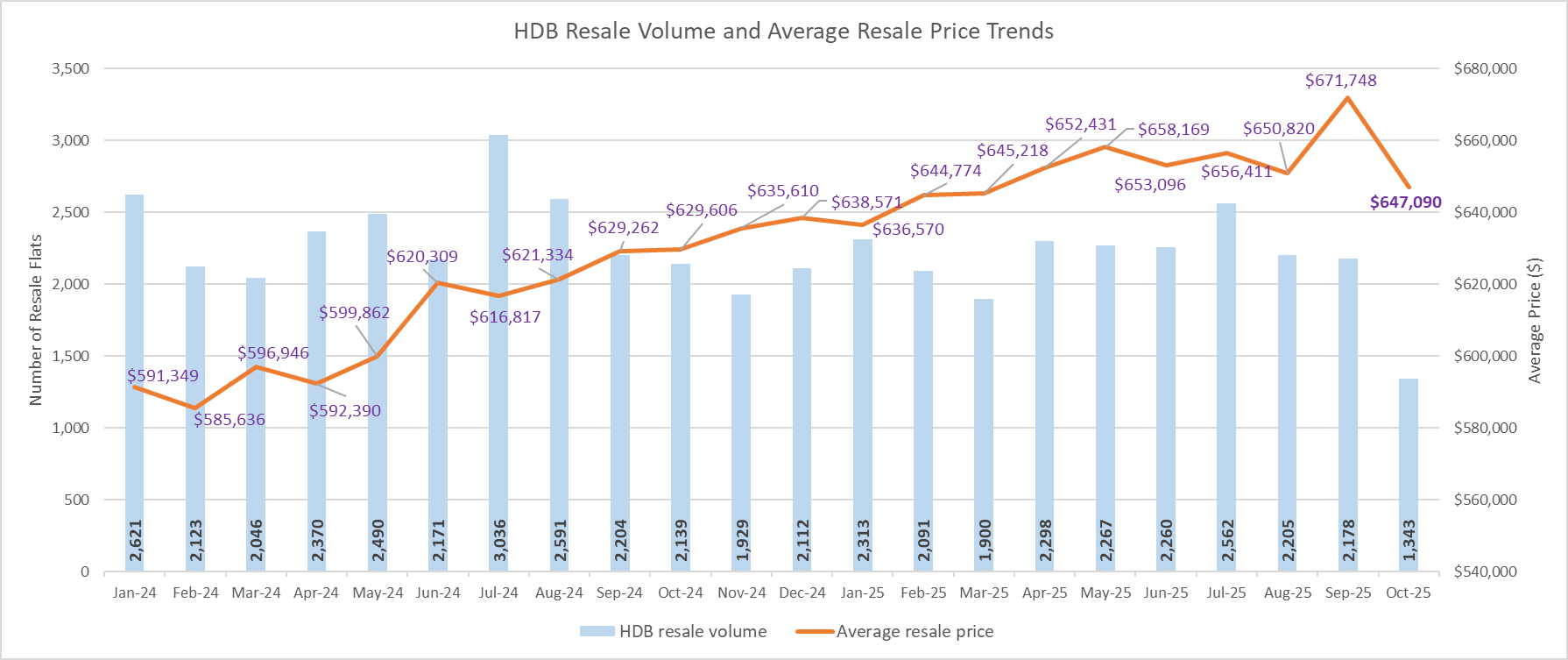

In October, the number of resale flat transactions slumped by 38% month-on-month (MOM) to 1,343 units from 2,178 units in September (see Chart 1). The most popular towns were Woodlands, Tampines, Yishun and Sengkang which collectively made up more than a quarter of the month's resale volume.

The weaker volume put a drag on prices, with the average HDB resale price falling by nearly 4% MOM to $647,090 in October (see Chart 1). Notably, this is the sharpest monthly average price decline in at least the last eight years, based on transaction data. The price decline in October was observed in both the mature and non-mature estates.

Chart 1: HDB resale volume and average resale price

It is possible that the HDB's build-to-order (BTO) exercise in October has dulled interest in the resale flat segment temporarily, as prospective buyers got pulled in to attractive BTO projects, such as the Berlayar Residences in the upcoming Greater Southern Waterfront precinct, Bishan Terraces, and Mount Pleasant Crest.

Meanwhile, BTO flats with shorter waiting times of less than 3 years - Ping Yi Court in Bedok, Fernvale Plains in Sengkang, and Yishun Glade and Chencharu Grove in Yishun - also drew healthy applications. All in, there were 31,095 applicants vying for 9,144 BTO flats in the October sales launch.

With the impending school holidays and festive seasons at the end of the year, it is likely that HDB resale transactions may remain muted in the coming months, while prices are expected to see measured growth. In the first nine months of 2025, the HDB resale price index rose by 2.9%, substantially slower than the 6.9% increase in the corresponding period in 2024. PropNex believes the slower price increase will help to promote a more sustainable housing market that is aligned with income growth.

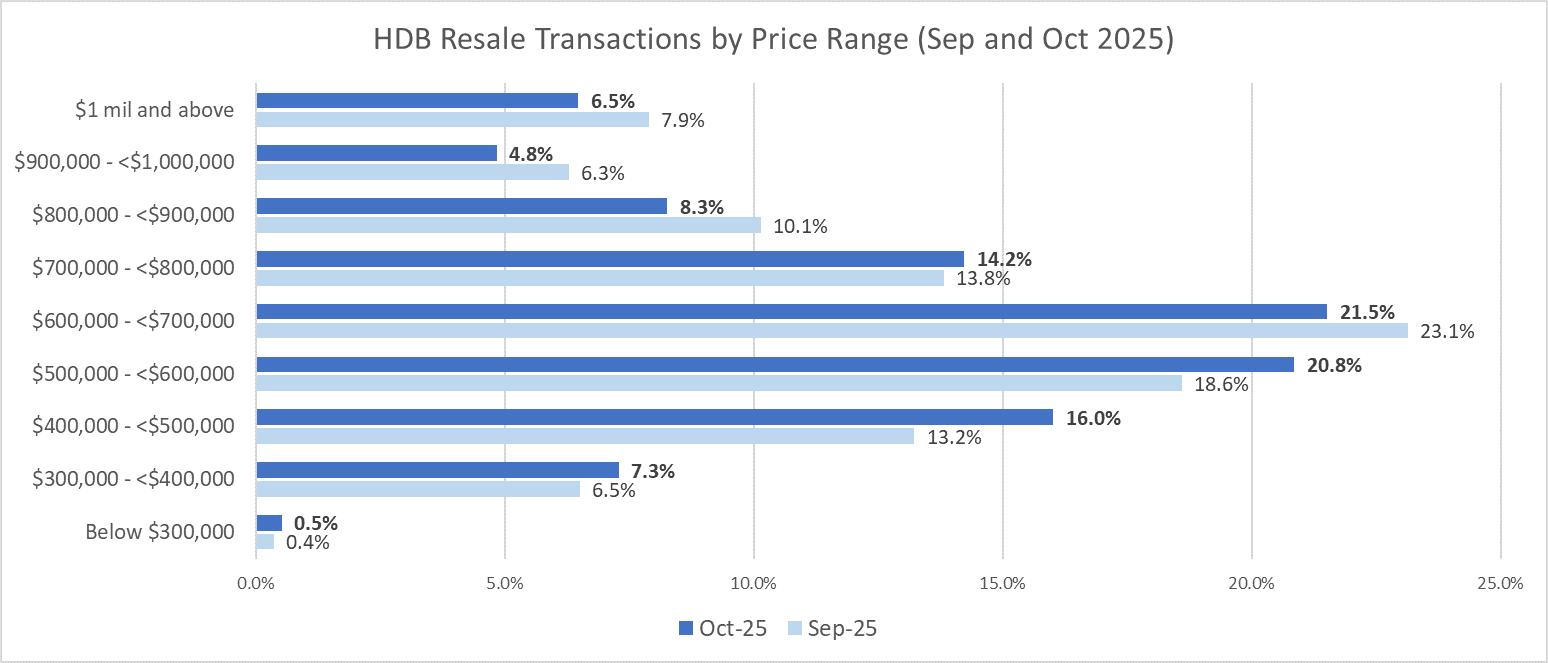

Transaction data showed that the proportion of flats resold that were priced at below $500,000 in October was 23.8% - higher than the 20.1% in the previous month. Meanwhile, about 42.4% of the resale flats sold fetched between $500,000 and under $700,000 each, compared with 41.7% in September. In contrast, 27.3% of the sales were priced at $700,000 to just under $1 million in October- down from 30.3% in the previous month. The proportion of flats resold for at least $1 million also fell from 7.9% in September to 6.5% in October (see Chart 2).

Chart 2: HDB resale flat transactions by price range

By flat type and town classification, the average resale prices mostly declined or saw marginal increase from September to October (see Table 1). Of the segments tracked, executive resale flats in mature towns saw the highest price growth at 2.0% MOM, while that of four-room flats in mature estates fell the sharpest by 3.5% MOM. The average resale prices of three- to five-room and executive flats in non-mature also weakened by 0.4% to 2.2% MOM in October. The price dips in both mature and non-mature towns may be due to the lower proportion of flats resold at higher price bands, including million-dollar transactions.

Table 1: Average HDB resale flat prices by flat type, by town classification

| Mature towns | Non-mature towns | ||||

| Sep-25 | Oct-25 | % change MOM | Sep-25 | Oct-25 | % change MOM |

3 ROOM | $469,193 | $476,228 | 1.5% | $464,153 | $457,709 | -1.4% |

4 ROOM | $794,747 | $766,877 | -3.5% | $613,473 | $599,962 | -2.2% |

5 ROOM | $938,593 | $937,932 | -0.1% | $720,477 | $717,312 | -0.4% |

EXECUTIVE | $1,010,057 | $1,029,821 | 2.0% | $887,461 | $873,461 | -1.6% |

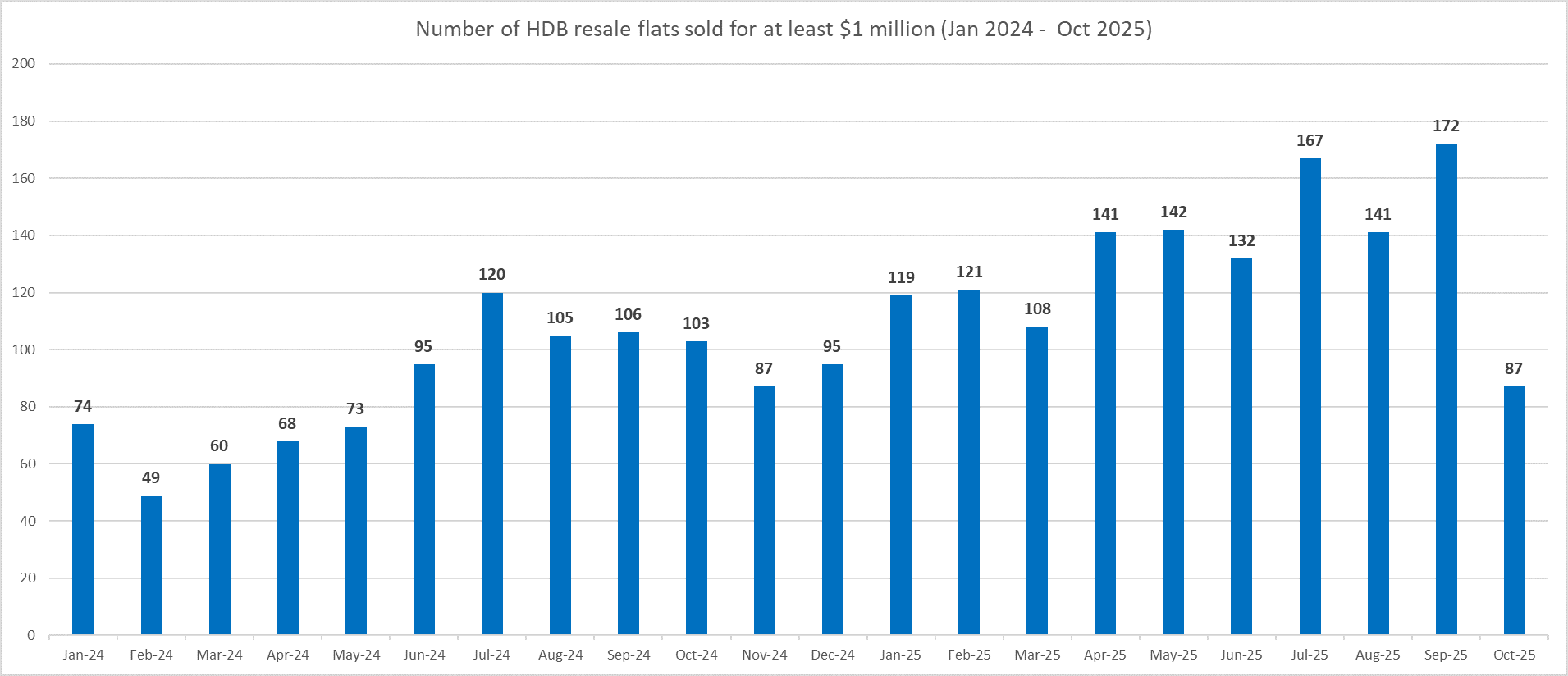

In October, the number of million-dollar resale flats sold fell markedly by 49% to 87 units, from the record high of 172 units in the previous month. This is also the lowest monthly sales of such flats in nearly a year, since 87 units changed hands in November 2024 (see Chart 3). The 87 units of million-dollar resale flats in October comprised 41 units of four-room flats, 31 units of five-room flats, and 15 executive flats.

Chart 3: Number of HDB flats resold for at least $1 million by month

Among the million-dollar resale flat deals in the month, six units are located in non-mature towns, namely in three in Woodlands, two in Hougang and one unit in Yishun. The rest of the units are in mature towns, led by Toa Payoh with 20 deals, followed by Bukit Merah and Kallang Whampoa with 13 and 11 such transactions, respectively.

During the month, there were two flats that have jointly fetched the highest resale price at $1.55 million. They are 5-room flats in City View @ Boon Keng, and Pinnacle @ Duxton in Cantonment Road (see Table 2).

Table 2: Top 10 HDB resale flats sold in October 2025 by Transacted Price

Town | Type | Street | Storey range | Floor area (SQ M) | Lease start date | Resale price | PSF ($) |

KALLANG/WHAMPOA | 5 ROOM | BOON KENG RD | 31 TO 33 | 117 | 2011 | $1,550,000 | $1,231 |

CENTRAL AREA | 5 ROOM | CANTONMENT RD | 28 TO 30 | 105 | 2011 | $1,550,000 | $1,371 |

TOA PAYOH | 5 ROOM | LOR 1A TOA PAYOH | 25 TO 27 | 114 | 2012 | $1,515,000 | $1,235 |

QUEENSTOWN | EXECUTIVE | MEI LING ST | 04 TO 06 | 146 | 1995 | $1,500,000 | $954 |

CENTRAL AREA | 4 ROOM | CANTONMENT RD | 43 TO 45 | 93 | 2011 | $1,480,000 | $1,478 |

CENTRAL AREA | 5 ROOM | CANTONMENT RD | 07 TO 09 | 107 | 2011 | $1,466,000 | $1,273 |

TOA PAYOH | 5 ROOM | LOR 1A TOA PAYOH | 25 TO 27 | 114 | 2012 | $1,460,000 | $1,190 |

CENTRAL AREA | 5 ROOM | CANTONMENT RD | 46 TO 48 | 105 | 2011 | $1,460,000 | $1,292 |

BISHAN | EXECUTIVE | BISHAN ST 13 | 04 TO 06 | 146 | 1987 | $1,438,888 | $916 |

BUKIT MERAH | 5 ROOM | HAVELOCK RD | 16 TO 18 | 114 | 2013 | $1,408,888 | $1,148 |

Looking ahead, PropNex expects the HDB resale flat market outlook to be one of increased stability and moderate price growth, as the higher supply of new flats from the HDB's BTO and Sale of Balance Flats exercises, price resistance among buyers, as well as prevailing cooling measures keep demand stable and resale prices in check

Contact a PropNex salesperson to find out more about resale HDB market trends.